Charitable Gift Annuities

Charitable gift annuities allow you to make a meaningful contribution while receiving fixed payments for life. It’s a way to support ECS and gain financial stability at the same time.

How it works:

- You donate cash or appreciated securities worth $10,000 or more to Episcopal Community Services. In return, you and/or another beneficiary will receive fixed payments for life.

- Your payment rate is based on your age (payments start at age 65 or later) and will never change.

- A portion of your payments will be tax-free.

- The older you are — or the longer you defer starting your payment — the higher your payments will be.

Benefits to you include:

- Lifetime payments that will never change.

- Capital gains tax savings when you fund your CGA using appreciated stock.

- You are eligible for an immediate charitable income tax deduction.

- Your gift passes to Episcopal Community Services outside of the estate process.

- You create your legacy of helping others to remember that their capacity is limitless.

Have questions? Get in touch with our Donor Relations team by using the form at the bottom of our Donate page.

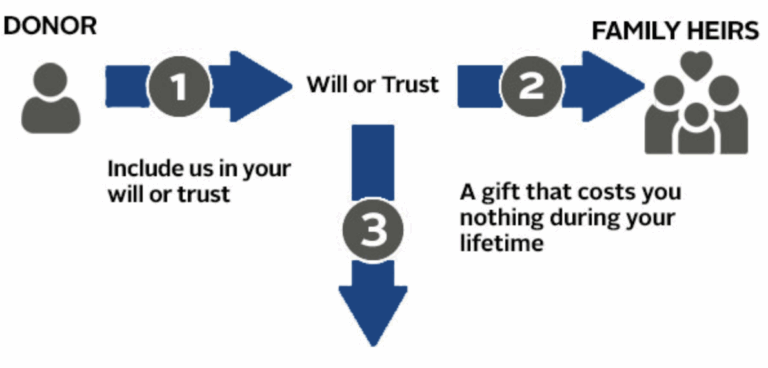

Charitable Remainder Trusts

A Charitable Remainder Trust (CRT) is a tax-free trust that pays you and/or other beneficiaries an annual distribution. This payment is either a percentage of the annual value of the trust, or a percentage of the original gift amount.

How it works:

- You transfer cash or an appreciated asset* into an irrevocable trust.

- The trustee then sells the asset, paying no capital gains tax, and reinvests the proceeds.

- For the rest of your life (or a term of years), you and/or another beneficiary receive payments from the trust.

- After your lifetime, the remaining principal is used to support the mission of Episcopal Community Services.

* While donating real estate is the most common way to fund a charitable trust, a wide variety of assets can be used, including cash, appreciated publicly traded or closely held stock, as well as oil, gas, or mineral interests.

Benefits to you include:

- You receive income for life for you or your heirs.

- You receive a charitable income tax credit for the charitable portion of the trust.

- You create your legacy of reducing intergenerational poverty.

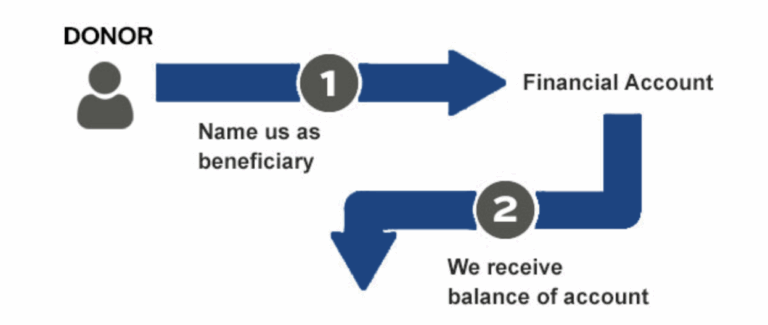

Qualified Charitable Distribution

You can transfer funds from your IRA directly to Episcopal Community Services. This is an effective way to have an immediate impact while ensuring our work of guiding Philadelphians out of a cycle of poverty and toward economic mobility.

Here’s how it works:

- You must be 70 ½ or older.

An individual may transfer up to a total of $108,000 per year and a married couple may give up to $216,000 to all organizations.

- Your gift must be transferred directly from the IRA account to Episcopal Community Services.

- Your gift is a transfer of funds from your IRA to Episcopal Community Services so it does not count as income for the year.

- If you are 73 and older, the transfer of funds counts towards your annual Required Minimum Distribution from your IRA.

- An individual may take a one-time QCD up to $54,000 to fund a charitable gift annuity (CGA) or charitable remainder trust (CRT).

You can download a sample letter for your IRA administrator here to start the distribution process. You may also be able to request a qualified charitable distribution through your online account portal.

Please note: If you are still working and contributing to a retirement account, this gift could impact your taxable income. Please consult a qualified advisor before making a gift.